Request IRS Transcript

If your FAFSA is selected for verification, and you did not use the IRS Data Retrieval option, or you changed the IRS data, you will be required to request a tax transcript from IRS and submit it to the Financial Aid Office. Personal copies of tax returns can no longer be accepted.

Please make sure you request a Tax Return Transcript. DO NOT request a Tax Account Transcript or Record of Account because they cannot be used for financial aid verification purposes.

Methods of Requesting a Tax Return Transcript

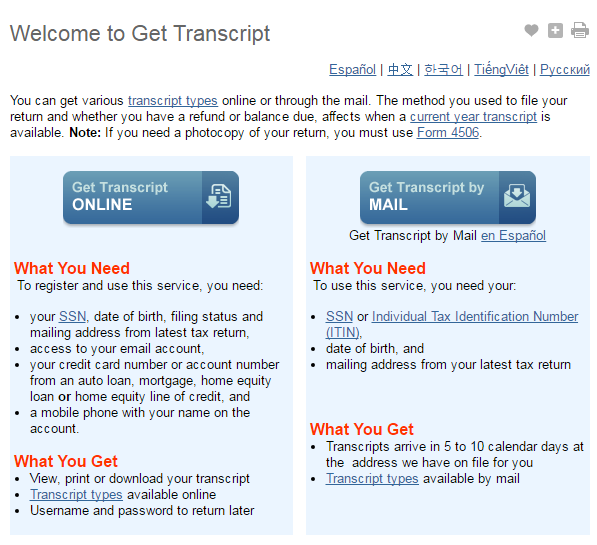

Online or by Mail

Visit: https://www.irs.gov/individuals/get-transcript

- Enter the requested information and click Continue.

- Select "Return Transcript" for the Type of Transcript, select the tax year requested for Tax Year, and click Continue. If successfully validated, tax filers can expect to receive a paper IRS Tax Return Transcript at the address on file with the IRS within 5 to 10 business days. IRS Tax Return Transcripts cannot be sent to an address other than the one on file with the IRS.

- Once received, deliver the Tax Return Transcript to the Student Financial Aid office.

Telephone Request

- Call the IRS at 1-800-908-9946.

- Tax filers must follow prompts to enter the primary tax filer's social security number and the numbers in their street address. Generally, this will be numbers of the street address that were listed on the latest tax return filed. However, if an address change has been completed either through the IRS or the US Postal Service, the IRS may have the updated address on file. For a joint tax return, use the primary tax filer's social security number, date of birth, street address, and zip or postal code.

- Select "Option 2" to request an IRS Tax Return Transcript and then enter the tax year requested.

- If successfully validated, tax filers can expect to receive a paper IRS Tax Return Transcript at the address on file with the IRS within 5 to 10 business days. IRS Tax Return Transcripts cannot be sent to an address other than the one on file with the IRS.

- Once received, deliver the Tax Return Transcript to the Student Financial Aid office.

Visit a Local IRS Office

- If online and telephone requests are not available because of address changes or other errors, please visit a local IRS office to address the problem.

- Locate an IRS office through www.irs.gov.

- Bring a form of photo identification.

- Request a Tax Return Transcript. Please note that some offices may not have the ability to print the Tax Return Transcript.